The challenges of 24/7 trading

The NYSE will be the next major index to turn on 24/7 trading. This change will significantly impact traditional equity trading and financial institutions will likely be lacking the IT infrastructure to support the major changes this will bring to their business.

We’ve highlighted the major challenges this presents financial institutions and some immediate steps they can take to get ahead of the curve in a previous post, but here are some of the biggest challenges that financial institutions will need to tackle:

- Increased volatility – With trading opened around the clock, there will be no buffer between an important event and stock prices.

- Reduced liquidity – While overall trading volume might increase, liquidity could become thinner at certain times, especially during what are currently off-hours, leading to larger bid-ask spreads and less efficient price discovery.

- Stress on operations – Continuous trading would require financial firms to operate on a 24/7 basis, thereby increasing operational costs and necessitating a more robust technological infrastructure to handle the continuous flow of trades

The good news is that there are modern technology solutions to this problem. Our team at Quasar has been working hard to solve this problem for the last 10 years. Let’s dive into how Quasar can help companies get ahead of the 24/7 trend and develop a true competitive advantage.

Raw, unlimited power

One of the biggest challenges this represents for financial institutions is being able to process tons of data quickly and continuously throughout the day. Quasar will deliver the raw power you need to process the terabytes of data per day that level 3 market data can represent. There’s no way around it: if you need to pull a heavy load, you need a powerful engine.

Quasar delivers the power you need by:

- Delivering unlimited native scalability and transparent slicing of work to run large tasks faster

- Outstanding compression, minimizing I/O

- Work on the data upstream to reduce downstream processing

Quasar power: scale up and out

An architecture that scales natively

To handle massive data volume well, you need to be able to distribute the workload efficiently. Your trading platform is likely not particularly good at this. This is why companies that try buying more expensive servers don’t see significant performance improvements.

Quasar has two ways to scale:

- Up, by running Quasar on more powerful computers.

- Out, by running Quasar on several computers

Scale up with multithreading

Whether on the server side or the client side, Quasar employs heavy multithreading. Meaning it can leverage multicore architectures very well.

This allows servers to process concurrent requests in parallel, even with insertion.

Multithreading is the number one bottleneck of legacy financial platforms because multithreading is extremely hard to retrofit in legacy code, and 30 years ago, computers with multiple processors were rare, expensive, and had hardware limitations that required code to be explicitly designed for them.

Scale-out with native clustering

The first version of Quasar was designed with clustering in mind. Clustering is when you can split your workload across multiple computers over a network.

Most products on the market have clustering as an afterthought, or the clustering is available only to work in expensive, unbounded, pay-as-you-go SaaS offering that hides the inherent limitations of the product by overusing precious resources.

Unlike other solutions on the market, when you insert data in Quasar, the data is sharded and divided into blocks to be evenly distributed across multiple computers. When you query, the engine knows where each information you need is.

Having native clustering, instead of retrofitting the feature, means everything in Quasar can be split across a farm of computers: ingestion, aggregation, computation, and analysis. That power gives you a very scalable solution that can support your immediate needs as well as scale to meet your future business needs.

The other key difference is that clustering is elastic, meaning you can add nodes after the fact to grow your database without worrying about changing your schema or migrating your data. It’s automatic! Having the capability to grow smoothly with your workload is critical when you do a long-term infrastructure investment.

Dividing work into smaller items, parallelizing those items

Whether you insert or query data stored in Quasar, your request is analyzed and split into smaller requests. This ensures that when you need to work on a significant volume of data, you can divide the work equally across the resources to do the job faster.

For example, if you are interested in the average price of a security for every minute over the last day, the query engine will understand that:

- You want to work in the previous 1,440 minutes of data.

- You need thus to compute 1,440 sums.

- And using these sums, compute 1,440 averages.

Analyzing how the data is distributed and the server’s computing power, it will then group the 1,440 work items optimally to balance execution speed, latency, and resource usage.

The key point here is that you remain entirely unaware, as everything operates automatically. There’s no need to adjust your code as your cluster scales up.

Compressing better and faster than state-of-the-art

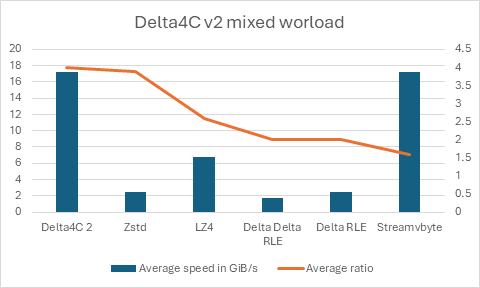

At Quasar, we are immensely proud of our patented compression algorithm. Delta4C, with version 2 hitting release soon, systematically outperforms outstanding general algorithms like LZ4 and ZStd.

Delta4C delivers the fastest compression speed with the best compression ratio possible at that speed.

The secret? Delta4C is an AI-enabled compression algorithm that recognizes the type of data you’re compressing and is even capable of delivering “infinite compression” by expressing data in its purest mathematical form.

Of course, not all data can be reduced to an optimal form. When optimal compression isn’t possible, Delta4C will choose the one best suited for the data in a catalog of algorithms.

For time series data, it’s often more efficient to store differences in values than the actual values when values are related. Sometimes, it can be more efficient to store the differences of differences. Some may ask, how do you encode the results? And isn’t a dictionary-based compression better for the data?

Delta4C is designed to select the optimal approach for your data, analyzing it quickly and delivering outstanding compression results in speed and ratio.

Compared to other algorithms on a mixed workload of data, the average compression ratio of Delta4C is seven times faster than ZStd!

On timeseries specific workload, the gap is much broader, with Delta4C achieving 16X compression ratios where ZStd achieves only 7X and classic timeseries compression algorithms such as Delta and Delta RLE staying below 10X.

| Algorithm | Average speed in GiB/s | Average ratio |

| Delta4C 2 | 17.21872765 | 4 |

| Zstd | 2.516756075 | 3.9 |

| LZ4 | 6.730744268 | 2.6 |

| Delta Delta RLE | 1.707377359 | 2 |

| Delta RLE | 2.402652861 | 2 |

| Streamvbyte | 17.25037112 | 1.6 |

Work upstream to reduce the pressure downstream

Materialized views enable you to “save a query” to be processed as data comes and can often be a fantastic way to optimize workload.

Quasar has a unique materialized view that aggregates data as it comes in memory and stores it on disk optimally.

Data is aggregated as soon as it hits the database, offering zero-latency aggregation.

Better yet, materialized views in Quasar have a low memory footprint by keeping only the data needed to keep the aggregation current in memory. For example, for a sum, it only keeps the current value.

Finally, Quasar supports unlimited materialized views, using a shared-nothing architecture that ensures that each view works independently.

Sophisticated data analysis

One of the Quasar platform’s key differentiators is its focus on the use case. What matters is how well you solve a business problem. Quasar has dozens of sophisticated features, making working with financial data a breeze.

Spend more on trading strategies and less on data engineering and IT infrastructure.

Managing multiple versions of the same data

Data changes all the time, and it can be handy to work with data now and then. For example, you might be interested in evaluating a trading strategy using the dividend information at the time of the trading. You might also want to compute your PnL with the most current information.

Quasar has built-in features that make this kind of operation extremely easy and if you want to learn more about how we do this, visit this link.

Orderbook rebuilding

Building a comprehensive vision of the order book is not trivial when you work with level III market data.

Quasar can replay orders and rebuild the order book at any time at sub-second speed. This is critical when you need to understand the state of the market immediately.

To rephrase: Quasar has an execution engine inside the database that can read and replay orders. The engine snapshots its internal state regularly to minimize computation pressure.

Managing all the subtleties of time

Managing timestamped data comes with many hidden challenges:

- Handling multiple time zones transparently

- Correctly iterating over days (e.g., understanding the calendar). For example, you want to group your data per week or day.

- Handling the case when a day doesn’t start at midnight but5 am

- Properly account for daylight savings.

Quasar supports natively these in two ways:

- A query engine that iterates intelligently over time, with calendar and time zone awareness

- Query language features to give you flexibility on how results are given to you

Advanced joins, window functions, and more

Suppose you come from a traditional data warehouse. In that case, you know that certain operations are complicated to express, such as time joins (a.k.a. ASOF joins), window functions that work on the time dimension, time-weighted average, and more!

Quasar takes away all the pain of solving these classic problems for you with powerful built-in language features that make the life of the analyst easier/that simplifies any analyst’s workload.

In short, the improved performance from Quasar allows you to make data driven decisions faster and with less resources.

Plug’n’play

One of the biggest challenges for large data projects is the pressure it can put on scare human resources. Quasar uses industry-standard SQL for queries, comes with several connectors, and has built-in features that simplify the job of IT staff.

Quasar also doesn’t force you to use a SaaS product with unpredictable pricing; it can be deployed anywhere, even at the edge of embedded form.!

Native SQL queries and a wealth of connectors

At the heart of the Quasar platform lies the QuasarDB time series database, which is queried in SQL.

This gives you excellent transparency and control and allows you to work directly on the golden source with an industry standard.

On top of all natively supported software, Quasar can be accessed from any software that supports Open Database Connectivity (ODBC), including Microsoft Excel.

Automatic data tiering

Quasar will automatically move hot data to your fastest storage and less frequently access data to slower storage.

When storing enormous amounts of data, this is key to keeping costs under control, mixing fast and expensive storage with slower but much more affordable ones.

Quasar can leverage the fastest storage, such as Intel Optane, and massive, affordable storage, such as AWS S3.

The beauty is that using AWS S3, for example, doesn’t require any crazy complicated configuration, as the support is native (and not through some abstraction layer), ensuring outstanding performance.

Ageless data handling

If you’re using legacy technology, you might be acutely aware of how querying data from the same day differs from querying data from multiple days ago.

Data age is irrelevant to Quasar as it will query and cache data to deliver unmatched performance whether the data is from 10 years or 50 minutes ago.

White Glove Service

While most customers initially choose Quasar because of its unmatched capabilities, our customers constantly tell us that the best part of Quasar is the outstanding level of service and support they get from our team.

Our customers achieve their business goals not only because our technology is the best on the market but of our team goes above and beyond for our customers. Our success is your success, and we are dedicated to making our customers successful.

In summary, Quasar provides financial institutions with the ability to succeed in a 24/7 equity trading environment. And our team’s dedication to customer service helps guarantee that Quasar customers can continuously sharpen their competitive edge.

If you want to get ahead of 24/7 trading, talk to our team today.